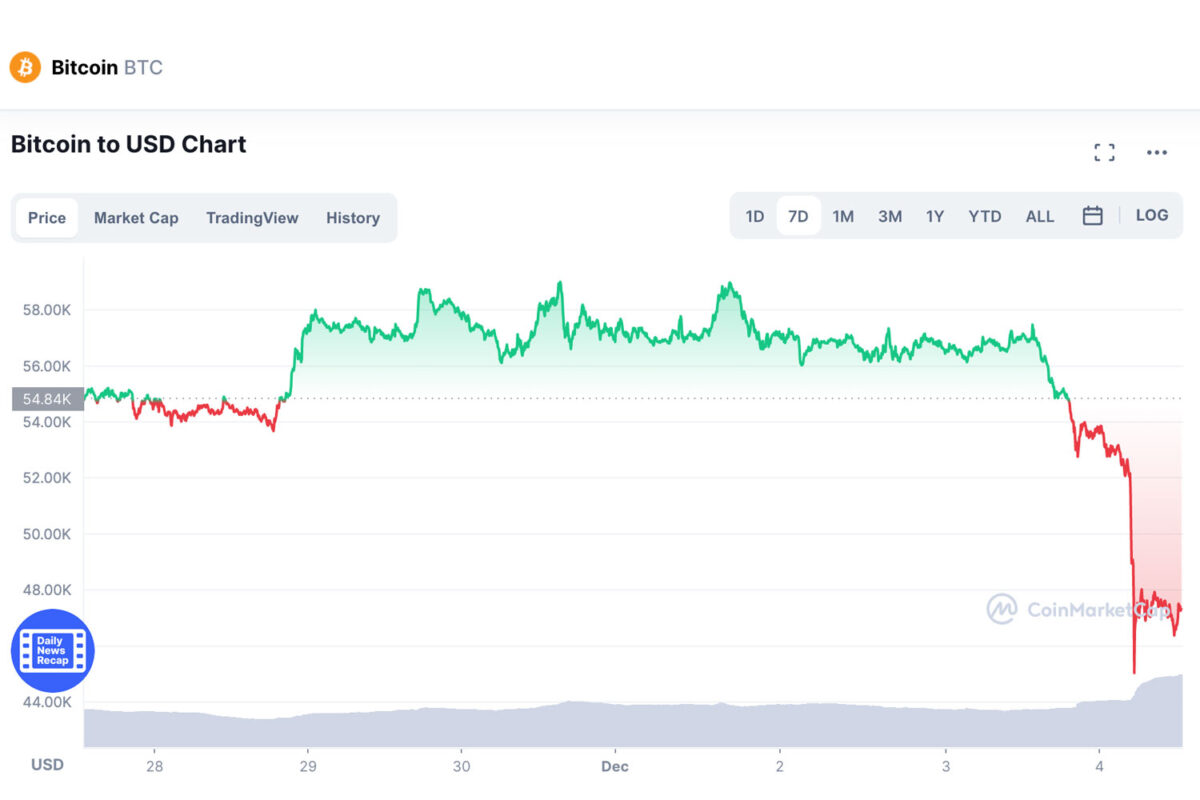

Bitcoin’s price just crashed by $10,000, in one of the wildest price drops we’ve seen since May. Bitcoin was cruising around the $56,000 mark for the last seven days. Then, early on Saturday morning it started to fall. By 4:30pm on Saturday it had fallen as low as $45,032 (a drop of more than $11,000), CoinMarketCap figures show.

It then rebounded very slightly, and between 5:30pm and midnight stabilised at around the $47,000 mark.

So: is Bitcoin going to continue stabilising? Is Bitcoin going to plunge even further (say, back to $10,000 per Bitcoin, as one prominent investor recently predicted)? Or is this is all fun and games in a notoriously volatile market?

First, let’s look at why it might have dropped – because the ferocity of the drop suggests there is more to it – much more to it – than just day traders closing up their position on a Friday leading to a classic (mild) weekend slump, and perhaps even more to it than crypto’s natural cycle where people have a tendency to sell soon after assets hit record hights (and Bitcoin did recently hit a record high).

Even before this latest drop, as of Friday, the market wasn’t faring fantastically. Forbes reported on December the 3rd (Friday) that Bitcoin and other crypto prices had fallen sharply, wiping around $300 billion USD off the combined crypto market in just two days.

Bitcoin was trading as high as $69,000 just weeks ago. So it’s fallen about 30%.

Bitcoin’s drop was followed by serious slumps in other prominent tokens, including Ethereum, Binance’s BNB, Solana, Cardano and Ripple’s XRP.

But why did Bitcoin itself drop?

The Bitcoin price plunge has come alongside some large stock market declines, as well as a warning made by big wig investor Louis Navellier that Federal Reserve tapering could pop the Bitcoin and crypto bubble.

“The Fed is tapering, and this should create a correction in risk assets, of which Bitcoin is a part,” Navellier said, according to an article published by Business Insider on Friday.

“The more the Fed tapers, the more volatility we should see in both stocks and bonds—and yes, bitcoin, too.”

The Fed is now beginning to “taper” its money slinging, following a hard rise in inflation and a recovering labour market.

While some believe there is still plenty of money sloshing around, even though the Fed is beginning to taper, and doubt the Fed will let markets ever fall too far, others are making more dire predictions.

Navellier, for instance, warned that Bitcoin could fall to $10,000 per Bitcoin, a stinging decline of 80% from its all-time high set last month of almost $70,000 (Bitcoin hasn’t been as low as $10,000 since September 2020).

“I would take a decline below $46,000 (the 200-day moving average) to be a yellow flag and a decline below the spring low of $28,500 to be a completed massive double top which points to a decline to below $10,000, which incidentally would match many of the multiple 80%+ declines in its storied history,” Navellier wrote, according to Business Insider.

Forbes reports: “The Bitcoin price has recorded similar such declines in the past, although bullish bitcoin and crypto investors remain confident Bitcoin’s price is going far higher in coming years.”

Business Insider reports: “While Navellier is making a dramatic prediction, Bitcoin has endured a few 80% dives before, the most recent of which started in December 2017 and spanned most of 2018. There were plenty of causes, including the government’s refusal to allow a Bitcoin ETF to trade, fears about hacks, and warnings from prominent investors like Warren Buffett.“

The Sun reported on Saturday that Bitcoin’s rapid decrease in price comes after China has “ramped up its clampdown on Bitcoin mining, which helped cause the last crash earlier this year.”

“The omicron variant has also led to risk aversion over concerns about what it might mean for global economic reopening in the coming months,” The Sun reported, too.

Bitcoin’s crash also comes a few weeks after Twitter’s CFO Ned Segal said he wasn’t down with investing Twitter’s corporate cash in crypto right now.

The Wall Street Journal reported last month that in an interview Segal said: “We [would] have to change our investment policy and choose to own assets that are more volatile,” adding that Twitter prefers to hold less volatile assets (like securities) on its balance sheet.

Additionally, The Wall Street Journal reported that Twitter is “assembling a team called Twitter Crypto to look into ways to help creators on the app to earn money or accept cryptocurrencies such as bitcoin for payment, and other ways to use blockchain technology.”

The Wall Street Journal also cited a bunch of other tech companies which have disclosed they do hold crypto assets, like Tesla and Square.

Watch Elon Musk and Mark Cuban discuss the potential real-world applications of meme coin ‘Dogecoin’ in the video below

On that note: though there’s a long way to go before taming this wild west, certain aspects of the crypto world have achieved some milestones of late in terms of legitimacy, leading many to become frustrated (see Jordan Belfort’s recent comments) with the hype around shitcoins giving the industry a bad name, and calling for more regulation to drive the space forward.

This in mind, if you have faith Bitcoin will bounce back, and you are a long term believer, this could indeed be a good time to buy (so long as you are prepared for volatility and worst-case scenarios and can afford to lose everything you put in).

If you are a short term investor, however, then you are heading into the unknown with not even a shred of a compass (i.e. gambling). This is because there’s no way of knowing if Bitcoin is going to fall further, or bounce back, in the coming days and weeks.

It’s also worth noting that, even among crypto believers, there is much disagreement about the future’s likely winners. Some people believe Bitcoin and Ethereum will always be the benchmarks and stores of wealth (more so Bitcoin than Ethereum), even if newer tokens outmanoeuvre them in certain ways (like speed and environmental bonafides). Others, meanwhile, are searching further afield into (lesser proven) disruptors like Nano, Solana and Cardano.

Disclaimer: This article is intended for informational purposes only. This is not financial advice. Never invest more money than you can afford to lose into any crypto.

Read Next

- I Bought $1,000 Worth Of Cryto Currency. It Was A Huge Mistake

- Best Crypto: 3 Best Cryptocurrencies To Buy Right Now

The post The Price Of Bitcoin Just Fell Off A Cliff. Is Now A Good Time To Buy? appeared first on DMARGE.

0 Commentaires